Title loan debt settlement provides a strategic path for individuals burdened by fast cash loans using their vehicle equity. The process involves assessing vehicle value, negotiating new terms with lenders, and making regular payments to reduce debt over time. Timely payments are crucial to avoid repossession. The resolution time varies based on factors like amount owed, income stability, loan terms, interest rates, and extension options. Strategic moves like increasing payments, avoiding penalties, and maintaining good credit can accelerate the settlement process for Fort Worth Loans, Semi Truck Loans, or other vehicle equity financing options.

“Unsure about the timeline for resolving your title loan debt? This guide provides a comprehensive overview of what to expect during the title loan debt settlement process. We explore the key factors that influence repayment periods, offering insights into how quickly you can regain financial control.

From understanding the initial steps to implementing strategies for faster settlements, this article equips you with knowledge to navigate your debt reduction journey effectively, helping you conquer your title loan obligations.”

- Understanding Title Loan Debt Settlement Process

- Factors Affecting the Timeframe for Settlement

- Strategies to Accelerate Debt Settlement Timeline

Understanding Title Loan Debt Settlement Process

Understanding Title Loan Debt Settlement Process

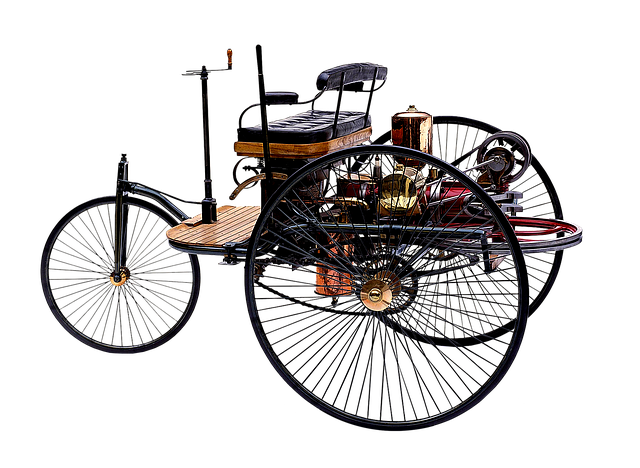

Title loan debt settlement is a strategic approach for individuals struggling under the weight of their fast cash loans. Unlike traditional debt consolidation, which often involves lengthy applications and strict eligibility criteria, title loan debt settlement offers a more direct path to financial relief. This process leverages the equity in an individual’s vehicle, allowing them to use it as collateral for a new loan with potentially lower interest rates and manageable repayment terms. The first step typically involves assessing the value of the vehicle and the outstanding loan balance. Lenders then negotiate with debtors to restructure the debt, aiming for a mutually beneficial agreement that facilitates faster repayment without the usual hassle.

Once a settlement plan is agreed upon, the debtor makes regular payments based on the new terms. These payments are applied towards both interest and principal, helping to reduce the overall debt burden over time. Debt consolidation can be an attractive option because it provides borrowers with the chance to simplify their financial obligations, eliminating multiple loans and simplifying their payment schedules. This streamlined approach not only reduces stress but also can save money on interest charges in the long run. However, it’s crucial to remember that timely payments are essential for successful debt settlement, as missed payments could lead to repossession of the collateralized asset.

Factors Affecting the Timeframe for Settlement

The duration it takes to resolve a title loan debt settlement can vary greatly and is influenced by several interconnected factors. One of the primary considerations is the amount owed, with larger sums often requiring more extended periods to repay. Additionally, individual financial situations play a crucial role; borrowers’ income stability and ability to make consistent payments significantly impact the settlement timeline.

Other relevant aspects include loan terms, interest rates, and the availability of loan extension options. Some lenders in Dallas offer flexible terms, which can aid in managing debt by stretching out repayment. However, these extensions may come with additional fees or higher interest rates, affecting the overall timeframe for settling the debt. Moreover, the borrower’s approach to resolving the debt—whether through direct negotiation or formal settlement processes—can also influence how swiftly the process unfolds.

Strategies to Accelerate Debt Settlement Timeline

Accelerating your Title Loan debt settlement can be achieved through several strategic moves. One effective approach is to increase your loan payments above the minimum required. Even small additional payments can significantly reduce the overall debt and shorten the settlement timeline. This strategy leverages compound interest, where smaller regular contributions can have a substantial impact over time.

Another key tactic involves exploring options for partial prepayment without fully paying off the loan. Many lenders allow borrowers to pay down a portion of their principal debt, which can speed up the process. This is especially beneficial if you have access to funds that can be applied towards your loan without incurring penalties. Additionally, maintaining good credit practices alongside timely payments can improve your lender’s perception, potentially leading to more favorable terms and an accelerated settlement for Fort Worth Loans, Semi Truck Loans, or other vehicle equity-based financing options.

Title loan debt settlement can be a viable option for borrowers seeking relief from their high-interest loans. Understanding the process, recognizing factors that influence settlement timelines, and employing strategies to expedite repayment can significantly impact the time it takes to become debt-free. By staying informed and proactive, individuals can navigate the complexities of title loan debt settlement more efficiently, ultimately reclaiming financial control.