Struggling with title loan debt and bad credit? Debt settlement, especially through vehicle equity programs, offers a way out. Strategize by extending loans, negotiating flexible payments, refinancing, or exploring new borrowing options leveraging vehicle collateral for better terms and faster debt elimination.

Struggling with title loan debt? It can feel like a trap, especially with poor credit. This guide is designed to empower borrowers seeking relief from this high-interest liability. We’ll explore the intricacies of title loans and their devastating effects on financial health. Then, we’ll delve into viable settlement options tailored for individuals with bad credit, providing strategies for securing a fresh start. Discover how to navigate this challenging situation and reclaim control over your financial future through effective debt relief tactics.

- Understanding Title Loan Debt and Its Impact

- Exploring Settlement Options for Bad Credit

- Strategies for Effective Debt Relief

Understanding Title Loan Debt and Its Impact

Title loan debt can quickly become a burden for borrowers with bad credit, as these short-term, high-interest loans are designed to be repaid swiftly. If repayment is missed or delayed, it can lead to a cycle of default and increasing fees, making it difficult to escape the debt trap. In such situations, seeking relief through title loan debt settlement becomes crucial.

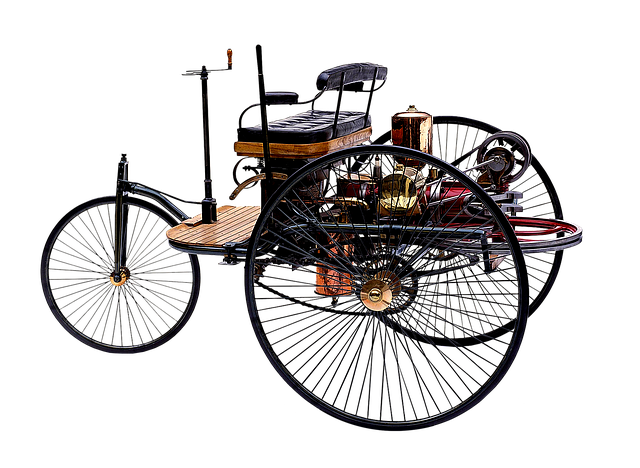

Understanding Title Pawn and secured loans is essential here. A title pawn involves using your vehicle’s title as collateral, while flexible payments allow borrowers to spread out repayment over time. However, if not managed properly, these secured loans can still result in significant financial strain. Therefore, exploring debt settlement options is a strategic move for those looking to regain control of their finances and break free from the constraints of high-interest title loan debt.

Exploring Settlement Options for Bad Credit

When facing Title Loan debt with bad credit, exploring settlement options is a crucial step towards financial freedom. Many borrowers often feel trapped due to stringent repayment terms and high-interest rates associated with these loans, especially when it comes to Semi Truck Loans, which typically require significant capital commitments. However, there are alternative strategies available for debt consolidation that can make repayment more manageable.

One popular option is leveraging the value of your vehicle through Vehicle Equity programs. These initiatives allow borrowers to use their vehicles as collateral, potentially securing more favorable loan terms and lower interest rates. By restructuring existing Title Loan debt and combining it with a new equity-based program, bad credit borrowers can navigate their financial challenges and work towards eliminating their debt obligations effectively.

Strategies for Effective Debt Relief

For borrowers with bad credit seeking relief from overwhelming title loan debt, strategic planning is key to successful settlement. One effective approach involves negotiating with lenders for a loan extension, allowing more time to repay. This strategy buys additional breathing room and can lead to lower monthly payments through flexible payments tailored to individual financial capacities.

Additionally, borrowers may explore options like loan refinancing or exploring alternative borrowing sources to replace high-interest title loans. Utilizing vehicle collateral, if available, could also provide access to more favorable terms, ultimately helping to settle debt faster and save on interest charges.

For borrowers struggling with bad credit and overwhelming title loan debt, settlement options offer a glimmer of hope. By understanding their financial situation and exploring various settlement strategies, individuals can navigate towards meaningful debt relief. Armed with knowledge from this guide, you’re equipped to make informed decisions, ultimately achieving financial freedom and a fresh start. Remember, seeking professional advice is crucial when considering title loan debt settlement.